Tuesday, August 23, 2016

What to Do AFTER the Storm

What to Do AFTER the Storm

While storm preparation is key, it’s also important to understand what you should do post-storm so you can begin the rebuilding process quickly.

- Notify Tower Hill of damage as soon as possible at800.342.3407 to start the claim filing process.

- Make temporary repairs in order to help avoid further damage, such as placing tarps on damaged roofs or boarding up broken windows. Hire only licensed, reputable repair companies and be sure to keep receipts for all repairs to provide to your claims adjuster.

- Take photos or video of damage prior to cleanup. If possible, do not throw away damaged items until the claims adjuster has reviewed them.

- Have your household inventory available for the claims adjuster, complete with photos/videos, receipts, and important information such as make and model numbers.

In partnership with Tower Hill, your insurance agent and claims adjuster are committed to helping you through the claims process step-by-step. Our goals are two-fold: your complete satisfaction and helping you repair and rebuild as quickly as possible.

How to insurance a home that does not pass a 4 point inspection.

How do I get insurance if my home can't pass a 4-point

inspection?

Most insurance

companies require a satisfactory 4-point inspection report be submitted to them

before they will insure an older home—typically more than 40 to 50 years old or

so, depending on the company. The purpose of the inspection is to determine if

there are any deteriorated or unsafe conditions in the home that have developed

due to its age, which have the potential to cause an insurance claim in the

future. The four “points” are: roof, plumbing, electrical, and heating/air

conditioning.

But if the

inspector turns up so many defects during the 4-point inspection that the

insurance company declines to insure the property until they are fixed, there

is another option. It’s called a “builder’s risk” or, sometimes, a “vacant

property” or “surplus lines” policy, and is often purchased by remodelers that

buy uninhabitable houses in order to have insurance while they are repairing

them for resale.

One company that

writes this type of policy is Tapco Insurance Underwriters. You cannot buy the

policy directly from the company, and need to find a local independent

insurance agent that represents them.

There are limited requirements

to secure this type of insurance. The policy is not cheap; so you only want to

use it for as long as it takes to get the house improved sufficiently to pass a

4-point inspection. The minimum policy term offered is usually 6-months.

As far as we know,

no company offers this type of policy for a manufactured/mobile home. Also,

many policies include a clause that does not allow you to get a refund for the

unused portion if you complete your repairs quickly, and want to cancel and

switch to standard homeowner’s insurance before the end of the policy term.

www.lehnandvogt.com

Lehn & Vogt Insurnace

2980 S McCall Rd

Englewood, FL 34224

Friday, July 29, 2016

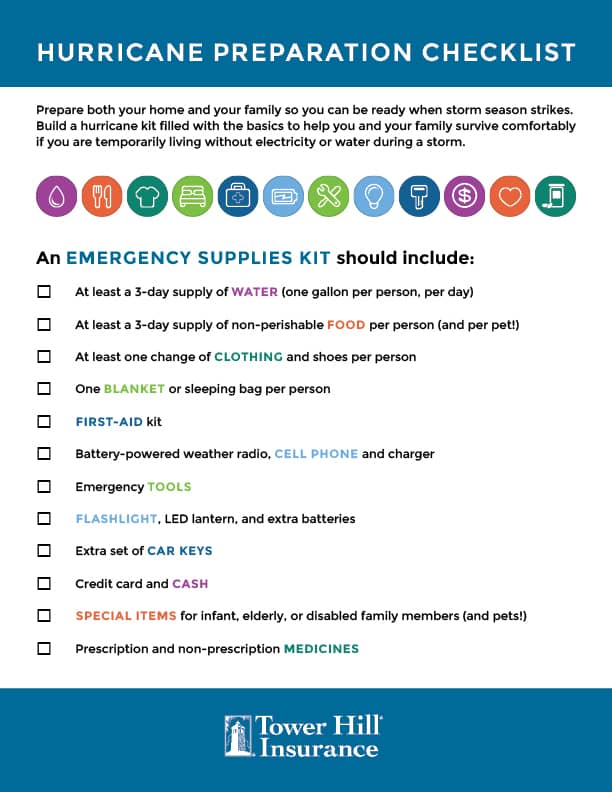

Florida Hurricane Check List

Your Hurricane Prep Checklist

Erika is forecast to impact Florida late Sunday or early Monday. Here’s a quick list of everything you’ll need to be ready!

(Click infographic to download a printable version.)

2980 S McCall Rd

Englewood, FL 34224

941-698-8877

THE CLAIMS PROCESS: What Can You Expect

The Claims Process: What Can You Expect?

So, you have damage to your property. Tower Hill and CastleCare are here to help! Here’s a step-by-step summary of what to do and how the claims process works.

- To file a claim, call our 24-hour Claims hotline at 800.342.3407 or file a claim online as soon as possible after it occurs.

- If you have a Tower Hill flood policy separate from your homeowners policy, please contact Torrent Flood at 877.254.6819.

- At the time a claim is first reported, a claim number is assigned and provided to you. It is helpful to have your current policy number and contact information available prior to placing the call.

- You can be immediately referred to Tower Hill’s CastleCare Team at 844.TOWER.11 (844.869.3711) for the repair and restoration process to begin. CastleCare provides emergency services, such as water removal and roof tarping, plus a full-service contractor network for both residential and commercial properties.

- During hurricane season and depending on the severity of storm damage, Tower Hill may set up a temporary Catastrophe Response Center in affected areas. In addition, the Department of Insurance often designates “Insurance Villages” to assist customers in those areas hardest hit by the catastrophe. Tower Hill will publish this information on THIG.com’s News Alert page and via Facebook and Twitter.

- Following receipt of a claim, they are sorted by severity and assigned to an adjuster for inspection.

- The Tower Hill adjuster will call you to schedule a time/date to inspect the damages. CastleCare works closely with your Tower Hill Claims adjuster to help determine the assistance needed. NOTE: Minor damages that do not require an inspection are often handled by our in-house staff; you will be contacted by telephone.

- Prior to the meeting with the adjuster, you should complete a home inventory list of damaged items, take photos or video tape of the damage, compile available receipts for damaged items and temporary repair expenses, etc. Providing a copy of this information to the adjuster will help speed up the claim review process.

- For repairs to your home, the CastleCare network contractors in your local area handle all project details, from start to finish.

- After a complete review and inspection, the adjuster report is submitted to the Tower Hill Claims Representative for review. CastleCare representatives submit all required documents relating to their services directly to Tower Hill.

- Following review, the claim is settled and payment is made.

Tuesday, March 29, 2016

2016 FEMA Flood Changes

|

|

|

Thursday, March 10, 2016

Did You Know? 10 Fun Facts about Daylight Saving Time

Did You Know? 10 Fun Facts about Daylight Saving Time: There's quite a bit of history to changing our clocks. Everything from candy makers to world history is tied to when we change our clocks each year.

Subscribe to:

Posts (Atom)