Thursday, October 20, 2016

Why You Should Always File a Claim for Hurricane Damage

Why You Should Always File a Claim for Hurricane Damage: After a storm, popular misconceptions, like fear of a rate hike or assuming the damage is lower than the deductible, stop some policyholders from filing a claim. Here's what you should know.

Tuesday, October 4, 2016

How to Create a Home Inventory

How to Create a Home Inventory: Would you be able to remember all the possessions you have accumulated over the years if they were destroyed by a fire?

Thursday, August 25, 2016

Tuesday, August 23, 2016

What to Do AFTER the Storm

What to Do AFTER the Storm

While storm preparation is key, it’s also important to understand what you should do post-storm so you can begin the rebuilding process quickly.

- Notify Tower Hill of damage as soon as possible at800.342.3407 to start the claim filing process.

- Make temporary repairs in order to help avoid further damage, such as placing tarps on damaged roofs or boarding up broken windows. Hire only licensed, reputable repair companies and be sure to keep receipts for all repairs to provide to your claims adjuster.

- Take photos or video of damage prior to cleanup. If possible, do not throw away damaged items until the claims adjuster has reviewed them.

- Have your household inventory available for the claims adjuster, complete with photos/videos, receipts, and important information such as make and model numbers.

In partnership with Tower Hill, your insurance agent and claims adjuster are committed to helping you through the claims process step-by-step. Our goals are two-fold: your complete satisfaction and helping you repair and rebuild as quickly as possible.

How to insurance a home that does not pass a 4 point inspection.

How do I get insurance if my home can't pass a 4-point

inspection?

Most insurance

companies require a satisfactory 4-point inspection report be submitted to them

before they will insure an older home—typically more than 40 to 50 years old or

so, depending on the company. The purpose of the inspection is to determine if

there are any deteriorated or unsafe conditions in the home that have developed

due to its age, which have the potential to cause an insurance claim in the

future. The four “points” are: roof, plumbing, electrical, and heating/air

conditioning.

But if the

inspector turns up so many defects during the 4-point inspection that the

insurance company declines to insure the property until they are fixed, there

is another option. It’s called a “builder’s risk” or, sometimes, a “vacant

property” or “surplus lines” policy, and is often purchased by remodelers that

buy uninhabitable houses in order to have insurance while they are repairing

them for resale.

One company that

writes this type of policy is Tapco Insurance Underwriters. You cannot buy the

policy directly from the company, and need to find a local independent

insurance agent that represents them.

There are limited requirements

to secure this type of insurance. The policy is not cheap; so you only want to

use it for as long as it takes to get the house improved sufficiently to pass a

4-point inspection. The minimum policy term offered is usually 6-months.

As far as we know,

no company offers this type of policy for a manufactured/mobile home. Also,

many policies include a clause that does not allow you to get a refund for the

unused portion if you complete your repairs quickly, and want to cancel and

switch to standard homeowner’s insurance before the end of the policy term.

www.lehnandvogt.com

Lehn & Vogt Insurnace

2980 S McCall Rd

Englewood, FL 34224

Friday, July 29, 2016

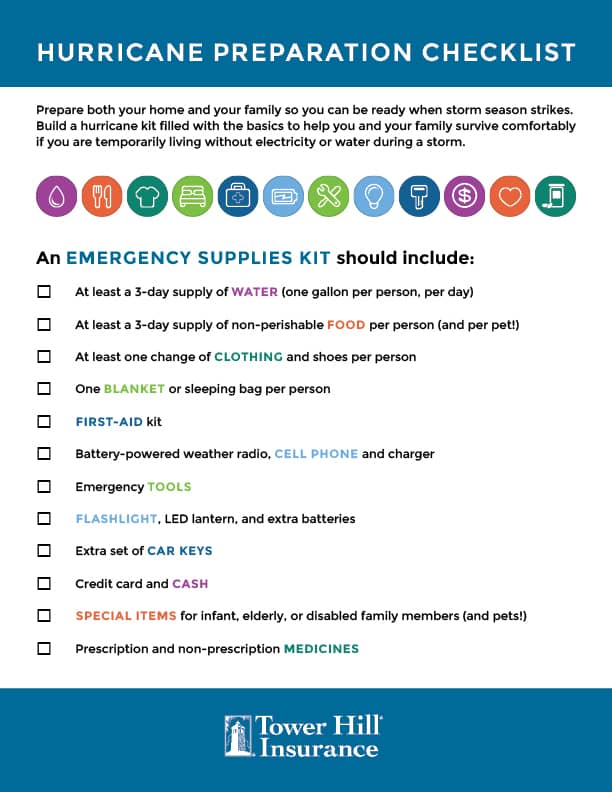

Florida Hurricane Check List

Your Hurricane Prep Checklist

Erika is forecast to impact Florida late Sunday or early Monday. Here’s a quick list of everything you’ll need to be ready!

(Click infographic to download a printable version.)

2980 S McCall Rd

Englewood, FL 34224

941-698-8877

THE CLAIMS PROCESS: What Can You Expect

The Claims Process: What Can You Expect?

So, you have damage to your property. Tower Hill and CastleCare are here to help! Here’s a step-by-step summary of what to do and how the claims process works.

- To file a claim, call our 24-hour Claims hotline at 800.342.3407 or file a claim online as soon as possible after it occurs.

- If you have a Tower Hill flood policy separate from your homeowners policy, please contact Torrent Flood at 877.254.6819.

- At the time a claim is first reported, a claim number is assigned and provided to you. It is helpful to have your current policy number and contact information available prior to placing the call.

- You can be immediately referred to Tower Hill’s CastleCare Team at 844.TOWER.11 (844.869.3711) for the repair and restoration process to begin. CastleCare provides emergency services, such as water removal and roof tarping, plus a full-service contractor network for both residential and commercial properties.

- During hurricane season and depending on the severity of storm damage, Tower Hill may set up a temporary Catastrophe Response Center in affected areas. In addition, the Department of Insurance often designates “Insurance Villages” to assist customers in those areas hardest hit by the catastrophe. Tower Hill will publish this information on THIG.com’s News Alert page and via Facebook and Twitter.

- Following receipt of a claim, they are sorted by severity and assigned to an adjuster for inspection.

- The Tower Hill adjuster will call you to schedule a time/date to inspect the damages. CastleCare works closely with your Tower Hill Claims adjuster to help determine the assistance needed. NOTE: Minor damages that do not require an inspection are often handled by our in-house staff; you will be contacted by telephone.

- Prior to the meeting with the adjuster, you should complete a home inventory list of damaged items, take photos or video tape of the damage, compile available receipts for damaged items and temporary repair expenses, etc. Providing a copy of this information to the adjuster will help speed up the claim review process.

- For repairs to your home, the CastleCare network contractors in your local area handle all project details, from start to finish.

- After a complete review and inspection, the adjuster report is submitted to the Tower Hill Claims Representative for review. CastleCare representatives submit all required documents relating to their services directly to Tower Hill.

- Following review, the claim is settled and payment is made.

Tuesday, March 29, 2016

2016 FEMA Flood Changes

|

|

|

Thursday, March 10, 2016

Did You Know? 10 Fun Facts about Daylight Saving Time

Did You Know? 10 Fun Facts about Daylight Saving Time: There's quite a bit of history to changing our clocks. Everything from candy makers to world history is tied to when we change our clocks each year.

Protecting Your Business: Slip, Trip, and Fall Hazards

Did you know?

- Over one million people in the United States experience a significant slip, trip, or fall each year.

- An average of 17,000 Americans dies from those slips and fall accidents.

- Slips and falls are the single most common reason for visits to the emergency room.

- The average cost of a slip and fall injury, including medical bills, physical therapy, and missed wages, is substantial. Further, these type losses drive the increased cost of business insurance.

- Slips and falls are the number two cause of accident death and disability, following behind automobile accidents.

Within a business or a residential community, there is a legal duty to provide a safe environment for persons who enter the place of business or property –customers, delivery persons, vendors, residents, etc. This means that if a trip hazard exists which is either known or should have been known with a reasonable inspection of the premises, there is a duty to warn and educate others about the hazard or remove/mitigate the hazard.

Why should a business or community correct fall hazards?

- Reputation, in general; Good Public Policy

- Appearance & Security of the Business or the Community

- Reducing or maintaining your insurance costs at a reasonable level

- Many claims, even though small, will make your insurance more expensive

- A large claim can make your insurance rates go up substantially

- Too many claims, either small or large, may make it difficult and expensive to find coverage

“Hazard? What hazard?”

People tend to trip on all sorts of things–displaced concrete walking surfaces, parking lot pot holes, wet floors, debris on the floor, uneven walking surfaces, and their own two feet. Here are the Basic Walking Surface Standards according to ASTM F1637-10 and the Florida Building Code:

- The maximum displacement between walking surface joints is ¼”

- If the displacement is between 1/4” and 1/2”, then the edge should be beveled

- The walking surface should be slip resistant

- Carpet should not be wrinkled, loose, or with holes, seams, &/or with frayed edges

- Parking lots should be smooth and even with no pot holes

- Wet floors should be marked with signage and the water or other substance cleaned up, immediately

- Parking stops should be in good condition & property secured

- Common areas and walkways should have adequate lighting

Property should be inspected on a regular basis for any type of hazard. An inspection check sheet is available for use in identifying hazards at businesses and within communities.

originally Posted by Jim Gibson Tower Hill Insurance

Monday, March 7, 2016

Preventing Home Flooding

Preventing Home Flooding During El Niño

With this year's expected strong El Niño, it is important to consider ways we can help prevent damage to our homes and communities. El Niño this year is expected to be one of the strongest on record and will continue to rage throughout the winter. Before the storm hits, follow these five steps to help protect your home from flooding.

Clean Out Gutters

Leaves, twigs, and other debris that has been dropped by birds or the wind can quickly build up in your gutters. Go around your house and make sure the gutters are clear of any leaves or debris to keep leaking and clogging to a minimum.Reattach Loose Gutters

After years of powerful wind and weather, your gutters may not be as securely fastened to your roof as they once were. Make sure they are tightly secured to decrease the possibility of detachment.Extend Gutters and Downspouts

Keeping water away from your foundation is critical during a downpour — extended gutters and downspouts will keep that rain water far away. A downspout should extend at least three feet from the foundation of your home — gutters work best when 7-8 inches wide. These changes will decrease the likelihood of your home's foundation from being saturated, which could lead to a flooded basement.Cover Window Wells

Covering your window wells will prevent water and debris from filling the area if a gutter clog occurred during the storm. Check these window wells often during the storm in case of leakage.Keep Storm Drains Clear

After gutter cleaning, you might have a lot of debris to dispose of — consider putting that debris in eco-friendly yard bags to keep streets clear. Dumping the waste on the side of the street will clog storm drains alongside the road and put a strain on your local resources and services. Do your streets a favor and keep those leaves contained.

It's important to know that most home policies don't cover flooding — just a few inches of water damage can cost thousands! If you decide that flood insurance is som

Wednesday, February 17, 2016

Why You Need A Private Disability Income Policy

Why You Need A Private Disability Income Policy

You know that you need a backup plan for the possibility that you could become disabled and unable to work. You need a way to bring in that lost income so that you can continue to pay your bills and take care of your family. This is known as disability income insurance, and you may already have some form of this coverage included as part of your benefits at work. Unfortunately, if you are relying on this coverage to get you through a serious disability, you may find yourself out of luck.

Verify Your Coverage

You need to know exactly what is covered and what is not in your benefits package. Take the time to talk to your HR department and ask for a copy of the policy. You need to look for a couple of things: short-term and long-term disability coverage, and what percentage of your salary will be paid out while disabled. Finally, you need to know how long the benefits last before running out and leaving you on your own.

Odds are when you look at this policy with a critical eye you will quickly realize that it's really not enough. If you were to face a serious long-term disability, most employer provided disability policies would not be enough to get you through. If this is the case, you need to consider a private policy.

Why It's Worth The Cost

Very few of us have enough savings put aside to keep us afloat for very long if we were unable to work. That is why disability insurance exists. A disability income policy is designed to pay your salary when you are unable to work, and a private policy almost always provides better and more comprehensive coverage than those provided by employers. In many cases, employer provided policies give you only a certain percentage of your salary and last for a limited period of time.

While a private policy will also have limitations, you are free to choose the policy that provides you with the best level of coverage possible and the most peace of mind. You can also extend your benefits beyond the employer-provided policy and ensure that you can get the longest possible time to recover and get back on your feet. The monthly premiums on a private policy are well worth the peace of mind.

Disability income insurance is a policy no one should be without; the loss of your income could leave your family devastated. Be prepared by taking the time to look over your current benefits and talking to your insurance agent about how to increase them.

9416988877

FEMA Responds to Florida’s Flood Rate Request, Sort Of

By Amy O' Connor | February 17, 2016

The Federal Emergency Management Agency (FEMA) has responded to Florida’s request to review the National Flood Insurance Program (NFIP) rates but it may not be as forthcoming and helpful as Florida officials had hoped.

In a letter dated Dec. 29, 2015 (see below), FEMA Deputy Associate Administrator for Federal Insurance and Mitigation Roy E. Wright acknowledged Florida Insurance Commissioner Kevin McCarty’s October, 2015 letter in which he asked FEMA to provide ratemaking data as it pertains to Florida to determine if the rates are “excessive, inadequate, or unfairly discriminatory.”

“FEMA is committed to ensuring its rate setting practices are fair, equitable, and transparent, and we appreciate your interest in supporting us in our efforts,” the letter to McCarty states.

Wright’s letter mentions a phone call discussion with FEMA staff and McCarty on Dec. 21, that included two of FEMA’s actuaries.

“We appreciate the collegial tone of that discussion and look forward to continue working with you in this effort,” Wright wrote. “As we mentioned during that phone call, FEMA is constantly reviewing and refining its rate-setting methodology and works to increase the transparency of that methodology.”

The letter outlines how FEMA has tried to increase the transparency of the rate-setting process, specifically since the passage of the Biggert-Waters Flood Insurance Reform Act of 2012. Wright also directed OIR to a June 2015 independent evaluation from the National Academy of Sciences that it says “provides a strong foundation as we continue to evaluate and improve our rate setting.”

Wright concluded FEMA’s response by saying that the agency is in its first steps of its efforts to “increase transparency and ensure our rates are fair and equitable.” Wright said he welcomed further discussions with McCarty on NFIP rate setting after McCarty has viewed the report.

The response from FEMA, however, does not provide the rate information Florida lawmakers are looking for to ease the expense of the Florida flood insurance marketplace.

“The response they sent basically says ‘we will eventually comply maybe someday,’” said Florida State Senator Jeff Brandes, who has been leading the charge, along with McCarty, to offer more affordable flood insurance options in Florida. “I am at a loss for why it is so hard for them to say either yes or no…The data is available.”

OIR said it is continuing discussions with NFIP on the issue. Brandes said he and other state lawmakers will allow some time to go by to see what FEMA’s next response is.

Brandes is confident that these discussions will move forward despite McCarty’s planned exit on May 2.

“OIR has made it very clear that this one of their highest priorities,” he said. “I think the next commissioner will absolutely continue to work for fairness for the Florida flood insurance market.”

Sahred from Insurance Journal

Friday, January 29, 2016

Option to increased Flood Rates.

The Flood Insurance Agency’s (TFIA) Private

Market Flood™ announces option to purchase two-year or three-year

prepaid policies to lock in current premiums and avoid annual rate

increases.

Over 528,000 properties have dropped their

flood insurance coverage since the Biggert-Waters Flood Insurance Reform

Act of 2012 was passed. FEMA’s total policy count has decreased from

5,620,017 policies to just 5,091,608 as of November 2015. That is an

average of 500 properties giving up their flood insurance protection

every day.

On April 1, 2016 many of the remaining

policies will see 25% premium increases, with every policy experiencing

some rate increase. Insurance companies will begin mailing renewal bills

reflecting these higher costs next week.

TFIA’s Private Market Flood program’s answer

to ever-increasing annual flood insurance premiums is an option to pay

$1 and two years premium, up front, for a two-year policy term,

guaranteeing no increase for the second year of the policy. There is

also an option to pay $2 and pre-pay three years premium to lock in the

rate for three years. Beginning next week, the prepaid option will be

presented to both new and existing customers.

Evan Hecht, CEO of TFIA, said: “Consumers

should be proactive, far in advance of an expiring flood insurance

policy, when seeking alternatives to rising FEMA flood insurance

premiums. If a lender uses mortgage escrow funds to pay a renewal

premium, including those premiums increased substantially, any time

before the existing NFIP policy expires, policyholders are unable to

cancel the renewal policy and replace it with a private policy. This is

the case even if the renewal policy does not become effective for

another two months. Insurance companies mail the renewal bills to the

lender 60 days prior to expiration. Once paid, the insured is held

hostage by FEMA and cannot take advantage of lower premiums in the

private market. Homeowners looking to switch to the lower cost Private

Market Flood insurance need to act early and demand their lender not pay

their current FEMA flood insurance renewal premium notice. Once a

lender pays the renewal premium, it is too late.”

Wednesday, January 13, 2016

What is FIGA?

What is FIGA?

The Florida Insurance Guaranty Association (FIGA) is a non-profit organization created to help protect policyholders in the event their insurance company becomes insolvent and is liquidated.

Property and casualty insurance companies are required to join the insurance guarantee associations in the states in which they are licensed to do business; Tower Hill Insurance is a member of FIGA.

It is especially important to do your research before you purchase an insurance policy to be certain that the company you are considering is financially strong and stable. If an insurance carrier is ordered into liquidation, the company no longer has any financial obligation to its customers. FIGA then steps in to assist the failed insurer’s customers by settling both new and outstanding claims; $300,000 is the standard claims limit for FIGA.

If your home’s value exceeds the maximum $300,000 amount that FIGA is obligated to pay for a claim, then you are responsible for the remaining cost to rebuild or repair your home. Depending on the amount your home or property is insured for, the gap between FIGA’s limit and the amount of coverage included in the policy originally purchased could be significant.

Because FIGA is a non-profit organization, it is primarily funded by assessing fees to the insurance industry. FIGA bases these assessments on a percentage of insurance premiums that each company receives from its customers.

Typically, Tower Hill is assessed a fee by FIGA, which we pay directly to them in advance of collecting monies from our customers. Then we recoup these funds — that we have already paid to FIGA — by collecting a percentage from each policyholder. On the declarations page at the front of your policy documents, this percentage fee is noted as a recoupment.

In December 2012, Florida property and casualty companies were assessed nine-tenths of one percent (0.9%) of the premiums collected from customers during calendar year 2011. Accordingly, a FIGA Recoupment Fee 2012 will be included on new and renewal Tower Hill policies that are effective March 15, 2013, or later. The fee varies slightly by insurance company and policy type.

To learn more about the Florida Insurance Guaranty Association and how this non-profit works to protect our state’s insurance customers, please visit the FIGA website.

Shared From Tower Hill Insurance www.thig.com

Subscribe to:

Posts (Atom)